Renters Insurance in and around Dallas

Looking for renters insurance in Dallas?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- DFW

- Dallas

- Preston Hollow

- Highland Park

- Lake Highlands

- Lakewood

- Uptown

- Downtown

- Plano

- Richardson

- Allen

- Texas

Calling All Dallas Renters!

There's a lot to think about when it comes to renting a home - number of bedrooms, location, parking options, townhome or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Dallas?

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside your space with coverage. If your rental is affected by a theft or a fire, some of your possessions might have damage. If your belongings are not insured, you may struggle to replace the things you lost. It's scary to think that in one moment, you could lose it all. Despite all that could go wrong, State Farm Agent Kristin Marquardt is ready to help.Kristin Marquardt can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if a pipe suddenly bursts in the unit above you and damages your furniture, your personal property is damaged by a fire or your bicycle is stolen from work, Agent Kristin Marquardt can be there to help you submit your claim and help your life go right again.

It's never a bad idea to make sure you're prepared. Get in touch with State Farm agent Kristin Marquardt for help learning more about options for your policy for your rented space.

Have More Questions About Renters Insurance?

Call Kristin at (214) 987-2886 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

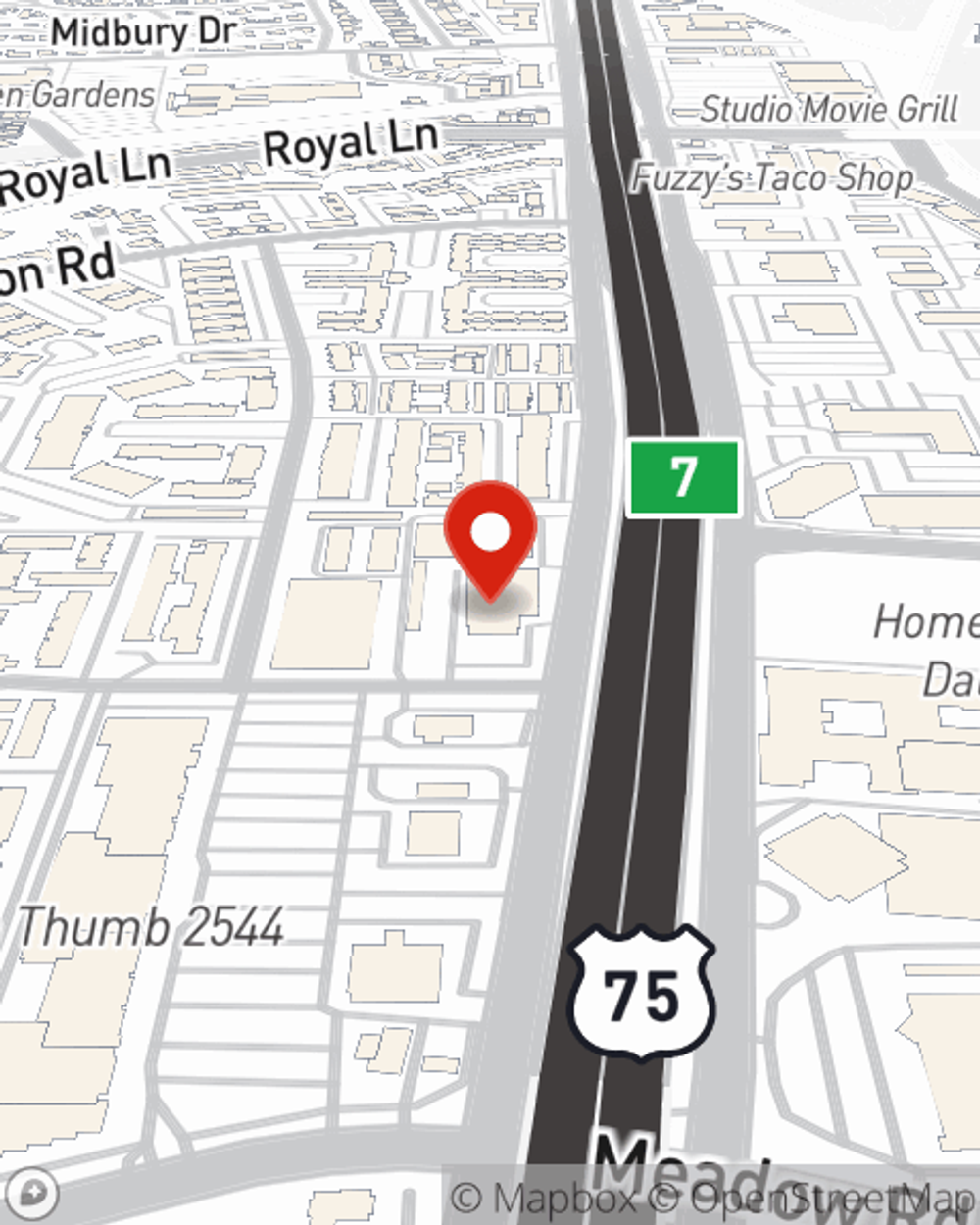

Kristin Marquardt

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.